WHY PEOPLE BUY LIFE INSURANCE

Life insurance has given me peace of mind knowing that money would be available to protect my family and estate in a number of ways, including:

- To Pay Final Expenses: The cost of a funeral and burial can easily run into the tens of thousands of dollars, and I don’t want my wife, parents, or children to suffer financially in addition to emotionally at my death.

- To Cover Children’s Expenses: Like most fathers, I want to be sure my kids are well taken care of and can afford a quality college education. . For this reason, additional coverage is absolutely essential while my kids are still at home.

- To Replace the Spouse’s Income: If my wife had passed away while the kids were young, I would’ve needed to replace her income, which was essential to our lifestyle. I also would’ve needed to hire help for domestic tasks we’d shared like cleaning the house, laundry, cooking, helping with schoolwork, and carting kids to doctor’s visits.

- To Pay Off Debts: In addition to providing income to cover everyday living expenses, my family would need insurance to cover debts like the mortgage so they wouldn’t have to sell the house to stay solvent.

- To Buy a Business Partner’s Shares: Since I’m involved in a business partnership, I need insurance on my partner’s life. The reason is so if he dies, I will have enough cash to buy his interest from his heirs and pay his share of the company’s obligations without having to sell the company itself. He has the same needs (due to the risk that I might die), and he simultaneously purchased insurance on my life.

- To Pay Off Estate Taxes: Estate taxes can be steep, so having insurance in place to pay them is essential to avoid jeopardizing assets or funds built for retirement. Use of insurance for this purpose is most common in large estates, and uses permanent (rather than term) insurance to ensure that coverage remains until the end of life.

Bảo Hiểm Nhân Thọ:

Thanh toán Chi phí cuối cùng. Trang trải chi phí cho con cái. Để thay thế thu nhập của người phối ngẫu. Trả hết nợ mua cổ phần của đối tác kinh doanh. Trả hết thuế bất động sản.

Thêm Thông tin hình ảnh

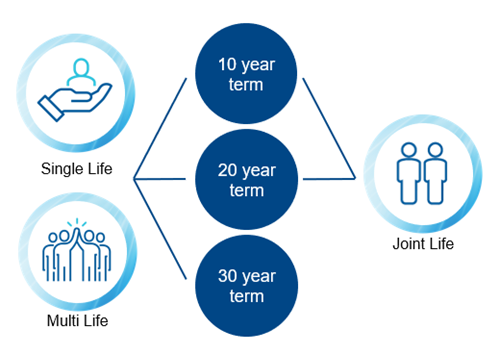

Term Insurance

Temporary, affordable protection.

We know that sometimes, while life insurance for you, your family, or your business may be top of mind, it also has to be affordable. With term insurance, you get guaranteed protection for 10, 20 or 30 years with premiums that work within your budget.

- Mortgage protection

- Income replacement

- Funding education

- Paying loans and expenses

- Business expenses

Term Insurance Plans

With Term Insurance through Equitable Life, you get to choose what kinds of benefits you want to add to your plan, who should be insured, as well as how long the plan should last for. When the term ends, your insurance will renew automatically for a higher premium or you can choose to terminate it. You can also switch your term insurance to permanent protection.

Whole life insurance

Participating Whole Life Insurance

Value. Choice. Flexibility.

Participating whole life insurance gives you lifetime protection with earnings. With guaranteed premiums, cash values and death benefits that suit your needs, participating whole life through Equitable Life helps you provide for your loved ones, grow your wealth, and protect what matters most.

Protect a child’s future

At first, life insurance for children may seem like a touchy subject. By purchasing a life insurance policy on your child or grandchild, you get the chance to build cash value which they can access in the future if they need it. The money can help with things like education expenses, down-payments, and more. When they reach the age of majority, the policy ownership can be transferred to them tax-free, giving them a head-start on their own financial planning.

Give them a head-start for tomorrow. Learn more

Equimax Plans

Equimax participating whole life insurance can be a great solution to help you:

- Create an estate plan for your loved ones or your favorite charity

- Protect the wealth you gained over your lifetime and want your loved ones to have

- Cover expenses like taxes or debts you may have when you die

- Grow your wealth and access it anytime for unexpected expenses or additional retirement income

- Put protection in place for a child or grandchild and help build wealth they can access in the future if they need it

Choose a plan that works for you!

Equimax Estate Builder®

- Higher long-term value

- A great choice for an estate transfer

- Premiums payable for life, 20 years, or 10 years

Equimax Wealth Accumulator®

- Higher early cash values

- A great choice for business protection

- Premiums payable for life or 20 years

Dividends

Participating whole life through Equitable Life is eligible for dividends. Dividends you get may be taxed and are not guaranteed. They could change and be different based on how well investments perform, how many claims are made, and other factors. Dividends are paid at the sole discretion of the Board of Directors. However, we work hard to have you share in our success. Just like we have every year, since 1936 when we started selling participating whole life.

Life Policy Collateral Loans

Borrow money from a bank or other lending company using the value of your life insurance policy. This can have tax benefits.*

* Availability of a loan from the third-party lending institution is not guaranteed by Equitable Life and is not part of the life insurance contract

What is permanent life insurance?

It’s guaranteed lifelong coverage that protects the people you care about. But it’s more than just insurance. Over time your policy can build value you can access for cash during your life, with certain tax implications.

You can access money in your policy through a loan or a withdrawal. And when you die, the people you’ve chosen receive a tax-free payment, similar to term life insurance.

How much insurance coverage do you need?

Ideally, you want to make sure your debts are covered, so you don’t leave major expenses behind for your loved ones.

Here are a few things to consider:

- Your income

- Net worth

- Family needs

- Debt

- Other insurance you have

How much does it cost?

Generally, permanent insurance costs more than term insurance, but there are a lot of factors that determine the cost of your policy, including:

-

Generally, insurance is less expensive when you’re younger.

-

Health

Family history, chronic diseases and lifestyle can increase costs.

-

Gender

Women live longer than men on average, so insurance may cost less.

-

Occupation

If you have a dangerous job, your insurance costs can be higher.